New Mexico reports $1.1 billion in resident-focused tax expenditures in FY25

New Mexico’s 2025 Tax Expenditure Report shows $1.1 billion in resident benefits, with food deductions and child tax credits leading all categories.

New Taxation and Revenue report shows nearly half of all tax expenditures directly benefited New Mexicans

Organ Mountain News report

SANTA FE - New Mexico directed $1.1 billion in tax expenditures to residents in Fiscal Year 2025, according to a recently released report from the New Mexico Taxation and Revenue Department.

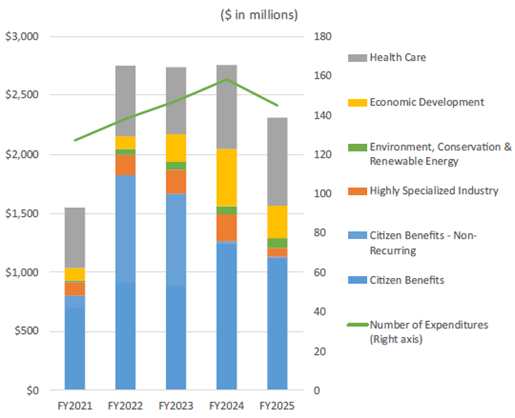

The agency’s 2025 Tax Expenditure Report estimates how much tax revenue the state forgoes through credits, deductions and exemptions. Nearly half of all tax expenditures — about 48 percent — were classified as direct benefits to New Mexicans. Officials say those investments support families, health care access and economic development through the tax code rather than direct spending.

Taxation and Revenue Secretary Stephanie Schardin Clarke said the report reflects the state’s efforts to help move thousands of families out of poverty.

The largest single tax expenditure in FY25 was the gross receipts tax deduction for retail food sales, totaling $397 million. The Child Income Tax Credit followed as the next highest under resident benefits. Parents claimed about $139 million in FY25, with up to $622 available per qualifying child. A total of 257,526 taxpayers used the credit.

Health care accounted for the second-largest category of tax expenditures at $743 million, or about 32 percent. The gross receipts tax deduction for prescription drugs, oxygen and medical cannabis was the highest within that category at $275 million, making it the second-largest expenditure overall.

Other expenditures supported economic development, specialized industries and renewable energy programs.

The report notes that several existing tax expenditures will sunset within five years, including deductions for liquor license lessors and holders, the high-wage jobs credit and the technology readiness credit. New Mexico currently has 149 tax expenditures, nine of which were added in this year’s report.

Residents can view the full report by visiting the Taxation and Revenue Department’s online Forms and Publications page and opening the “Tax Expenditure Reports” folder.

Doña Ana County ice skating rink now open for winter season — The new indoor rink is officially open for winter and will operate through Feb. 19.

Las Cruces motel standoff ends with arrest of man wanted in Arizona — Police arrested a man sought in Arizona after responding to a report of sexual assault.

Las Cruces police share tips to stop porch pirates this holiday season — Officers outlined ways residents can keep packages safe as deliveries increase.